What Is the Unshared Amount?

When it comes to healthcare expenses, most people are used to navigating high deductibles, then coinsurance, and finally an out-of-pocket maximum—if they get there. For 2025, that out-of-pocket limit is now $9,400 for individuals. But here’s the catch: most people never reach that threshold until the end of the year, only to have it reset in January. That structure often leaves families paying thousands of dollars without ever receiving the full benefit of their plan.

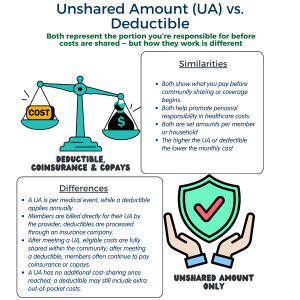

At ShareWELL, we’ve taken a different approach. Instead of a deductible and coinsurance, our model uses an Unshared Amount (UA), which is typically more cost-effective and transparent. However, it’s important to understand how it works—and how it differs from the traditional model—so members can make fully informed decisions about their care.

What Is the Unshared Amount?

The Unshared Amount is the portion of an eligible medical event that a member pays out of pocket before the community steps in to share expenses. Each member can choose from three different UA amounts when they first join, which will determine their monthly cost and out-of-pocket cost for medical events.

Different Than a Deductible—and Often More Affordable

Here’s where the model differs from traditional health plans. In a standard plan, you pay a deductible, then coinsurance, and only after significant spending do you hit your out-of-pocket maximum. With ShareWELL, there is no coinsurance or step-by-step progression. Once you meet the UA for a particular event, the rest of that eligible expense can be shared by the community.

For many members, this structure results in lower costs. Instead of paying toward a $9,400 max each year, ShareWELL members are responsible for up to two UAs per household per 12-month membership period. That’s currently $1,500 per UA—so in most cases, a household would not pay more than $3,000 toward eligible medical events each year.

When Smaller Expenses Add Up

But it’s important to acknowledge a less favorable, though realistic, scenario: not all medical bills will meet or exceed the UA threshold. Those smaller bills don’t count toward the two-UA maximum, which is applied per eligible event, and are not cumulatively distributed across all medical spending.

For example, a household could experience two significant healthcare events and pay $1,500 each, reaching the UA cap of $3,000. But if they also have two additional events that cost $500 after discounts, well below the UA, they would also be responsible for those expenses. That brings their total out-of-pocket for the year to $4,000. In this scenario, the household pays more than the two UA limits, but still far less than they would likely pay in a traditional plan with high premiums and an out-of-pocket max of $9,400 or more.

More Value, Even in Tougher Scenarios

Even in that less-than-ideal example, ShareWELL members often come out ahead. Why? The average monthly membership cost is about half what most people pay for a traditional plan. When you combine lower monthly costs with the UA structure and sharing model, most members save significantly over a year, even when a few smaller bills fall outside of sharing eligibility.

Incentivizing Smart Healthcare Choices

One of the most powerful aspects of the UA model is its encouragement of members to be savvy, informed healthcare consumers. Unlike traditional models that often hide costs behind opaque billing and copays, ShareWELL empowers members to understand what they’re paying for, and why.

Healthcare costs for the same procedure can vary dramatically depending on where you go, how you present for care, and how payment is handled. The UA structure incentivizes members to seek quality care at fair prices because making smarter choices benefits individuals and the community.

That’s where ShareWELL’s Advocacy Team steps in. Members can access various tools, support services, and expert guidance to help navigate the system, identify cost-effective providers, and avoid unnecessary expenses. Whether reviewing treatment options, comparing provider prices, or negotiating rates before care is received, ShareWELL’s support infrastructure is designed to keep costs down without compromising quality.

This proactive approach helps protect the community fund, reduces each member’s financial burden, and ultimately drives more sustainable, transparent healthcare.

A Path to Lower Your UA Responsibility

Another important feature of ShareWELL’s model is its ability to reduce or even waive some UA through proactive planning. When members work with ShareWELL Partners ahead of scheduled care, such as surgery or imaging, our team helps locate high-quality, cost-effective providers and negotiates better rates. This level of coordination helps reduce overall healthcare costs and can eliminate some of the member’s UA responsibility entirely.

Another valuable way to lower your UA is by partnering with the ShareWELL Negotiation Team. Our experienced negotiators can work directly with healthcare facilities, even after services are completed, to apply for and complete hospital self-pay discount applications for members. This process may include submitting financial information to qualify for the deepest available discounts for self-pay patients. By using these programs and our team’s expertise, members often see a significant reduction in their total UA, making medical costs more manageable and transparent.

Designed for Real Life

Healthcare doesn’t always fit neatly within a calendar year. Events like maternity or cancer treatment can stretch across many months. Unlike traditional plans that reset in January, potentially causing you to meet deductibles and max out-of-pocket twice, ShareWELL’s UA safeguard operates on a rolling 12-month basis. That means you get consistent protection regardless of when a medical event starts or ends.

The Bottom Line

The Unshared Amount is not a deductible, and it’s not an out-of-pocket maximum. It’s a member’s responsibility designed to keep costs manageable and aligned with the actual expenses of care. Yes, there may be moments when smaller bills fall under the sharing threshold, but even then, most members spend significantly less than they would on traditional plans, both monthly and over the course of a year.

It’s a more flexible, transparent approach to healthcare, one designed to reflect real-world needs, not just policy structures.