At ShareWELL, we know healthcare choices can be confusing. Members often ask how Health Sharing works, how it differs from insurance, and how our MEC (Minimum Essential Coverage) plans fit into the picture. This Q&A guide addresses the most common questions so you can feel confident in your membership and the flexibility it provides.

1. Is a Health Share the same as Insurance?

No, a Health Share is not insurance, and that is intentional. Health sharing communities are built around member cost-sharing rather than government-regulated insurance models. This allows them to stay focused on community-driven, transparent care while reducing unnecessary costs.

a. Strong Member Protections

Although Health Shares are not regulated like insurers, organizations such as ShareWELL operate under binding Member Guidelines that are legally enforceable through state contract law. This means that if obligations are not met, members have similar legal protections to those of an insurance policy, without the bureaucratic delays or red tape.

b. How It Works in Practice

For eligible medical sharing requests (e.g., hospitalizations, surgeries), health shares function just like coverage: bills get paid from pooled member funds, often at discounted cash rates. Plus, you get broader access—no narrow networks forcing you to specific doctors; see anyone, anywhere, including out-of-state or abroad.

c. Understanding the Myth of “Guarantees”

The word “guarantee” in insurance advertising can be misleading. No system can promise perfect protection. In fact, large insurers routinely deny claims. UnitedHealthcare, for example, rejected about one in three claims in 2024, often citing “not medically necessary.” Health sharing communities like ShareWELL are transparent about guidelines and emphasize preventive care to keep overall costs manageable for everyone.

d. Affordable and Flexible

Without the Affordable Care Act mandates, Health Shares do not require members to pay for coverage they do not need. This creates savings of 30 to 60 percent compared to traditional insurance plans, often reducing family healthcare costs by thousands each year.

e. A Proven Approach

Health sharing is not new. More than 2.4 million Americans currently participate in Health Sharing communities, which together have shared over 30 billion dollars in medical expenses since 1993. Member satisfaction remains high, averaging 98 percent nationally.

f. ShareWELL’s Member Advantage

ShareWELL goes a step further by prepaying major medical expenses when possible. This eliminates financial stress before procedures and helps members focus fully on recovery.

2. Can I still see my own doctor?

Yes. As a ShareWELL member, you can use any provider anywhere in the country. You are never restricted to a network or forced to switch doctors.

3. How does ShareWELL treat pre-existing conditions?

A pre-existing condition is any illness or injury for which you received treatment, medication, or medical advice within 24 months before your membership began. This also includes any ongoing management of chronic conditions.

-

For cancer, the lookback period is 36 months. This includes preventive treatments, medications, or follow-up related to a prior diagnosis.

-

Certain conditions, such as high blood pressure, high cholesterol, thyroid disorders, and type 2 diabetes, are not considered pre-existing unless hospitalization occurred in the previous 12 months.

A Practical Way to Look at It

Almost everyone has something that could be considered pre-existing. In reality, most of these conditions are common and manageable, not the kind that lead to major expenses or hospital stays. Many are self-managed or require only occasional low-cost visits. Examples might include mild back pain that does not require surgery, small dermatological procedures such as a MOHS treatment that costs under 1,000 dollars when paid as a self-pay patient, or the general aches and pains that come with age.

The key is understanding whether your condition could lead to a significant medical expense in the near future, especially within your first year of membership, when sharing for related medical bills would not be eligible.

If you expect a major cost tied to an ongoing or recent condition, take a moment to calculate whether those potential expenses might outweigh the savings you would receive from joining a Health Share such as ShareWELL. Compare this to the total cost of a traditional insurance plan, including monthly premiums, deductibles, and coinsurance.

For instance, if you know that a surgery or other high-cost treatment is likely soon after joining, a traditional plan may be the better short-term option. However, for individuals and families who are generally healthy or managing stable, low-risk conditions, the lower monthly costs and flexible care options available through ShareWELL can offer meaningful long-term savings and greater freedom in choosing care.

Why This Model Works

This approach keeps monthly costs affordable for the majority of members while still protecting the community from excessive risk. It also makes Health Sharing an excellent fit for people who prioritize preventive care and want the flexibility to choose their own doctors without the high premiums of insurance-based plans.

By doing the math and understanding your personal health outlook, you can determine whether a health share is the right fit for you. Many members find that once they evaluate their likely medical expenses versus what they would spend on traditional coverage, the savings and flexibility make ShareWELL an ideal choice.

4. What does ShareWELL offer for maternity care?

ShareWELL provides one of the most innovative maternity programs in the country. Members can have their entire pregnancy and delivery costs shared for as little as $1,500.

To encourage smart spending, members who keep their maternity expenses within cost guidelines can receive six months of free diapers. ShareWELL also supports natural and homeopathic maternity options, giving families freedom in how they approach childbirth.

Maternity Waiting Period: Conception must occur at least 30 days after your membership begins for maternity expenses to be eligible for sharing. If conception occurs within the first 30 days, or if you are already pregnant at the time of enrollment, maternity-related expenses will not be eligible.

5. Will I have to pay out-of-pocket for major medical expenses?

No. ShareWELL provides prepaid medical cards to cover approved procedures. This means many surgeries and hospital stays are paid before you ever step into the facility. It is a powerful way to eliminate the worry of medical debt and protect members from financial strain.

🩺 Q&A: Understanding MEC Plans and How They Fit with Health Sharing

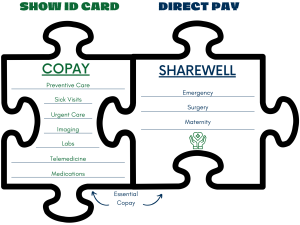

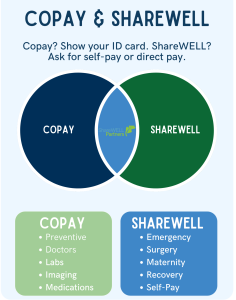

1. How do MEC plans fit with the ShareWELL Health Share?

MEC plans are designed to complement your health sharing membership. They cover preventive care and lower-cost medical services, typically under $1,500. MEC plans ensure members meet ACA preventive requirements and can provide 100 percent coverage for annual wellness visits, mammograms, and colonoscopies.

The Copay MEC option expands benefits to include primary care visits, specialist consultations, urgent care, lab work, imaging, and prescription coverage with low copays.

2. What provider network do MEC plans use?

The MEC Copay and HSA plans use the PHCS network, one of the largest in the United States, with over 920,000 providers. This network is paired with a Reference-Based Pricing (RBP) model for out-of-network care. Members can see any doctor they choose while still reducing the risk of unexpected or inflated billing.

For major medical needs under the Health Share, provider choice remains completely open.

3. What is a MEC Health Plan?

A Minimum Essential Coverage (MEC) plan is designed to meet the Affordable Care Act’s requirement for basic health coverage. MEC plans help individuals and employers avoid ACA penalties while ensuring access to essential preventive services at no cost.

These plans are especially appealing to employers seeking affordable, compliant benefits for their teams. MEC Plus plans, as described by Essential Benefit Administrators, combine preventive care with additional benefits for everyday medical needs such as primary care visits and prescriptions.

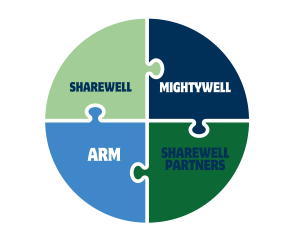

4. How does a Third-Party Administrator (TPA) enhance MEC plans?

A Third-Party Administrator, or TPA, such as Alternative Risk Management (ARM), manages administrative functions for employers. This includes processing claims, providing access to provider networks, and offering member support.

Partnering with a TPA allows employers to customize their MEC plans while ensuring smooth administration and responsive service. ARM’s member portal at www.altrisk.com allows members to review claims, ask questions, and access support tools anytime.

✅ The Takeaway

Health sharing with ShareWELL empowers members with freedom, transparency, and affordability. When paired with MEC coverage, members receive both preventive care and major medical support—all without the high costs and restrictions of traditional insurance.

Your health is personal. ShareWELL simply helps you protect it with choice, confidence, and community.