The Benefits Puzzle: A Smarter, More Affordable Approach

Managing healthcare can seem overwhelming, but relying on just one company to handle everything isn’t always the best solution. Although it may seem straightforward, relying on a single plan and provider often results in higher costs and subpar customer service. A more strategic option is available in today’s healthcare environment, using multiple plans to better meet your needs.

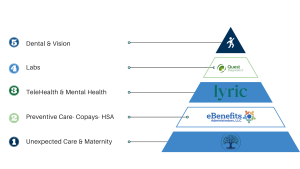

Think of it like putting together a healthcare puzzle. Each piece, from Health Share to preventive plans, labs, virtual care, and more, serves a specific purpose. By thoughtfully combining these options, you can create a custom healthcare plan that works best for you or your employees.

Here’s why using several plans can be the key to more innovative, more affordable healthcare.

Customization That Meets Individual Needs

Healthcare is not one-size-fits-all, especially for small businesses or families where everyone has different needs. Multiple healthcare plans allow you to handpick coverage options based on your requirements. For example, you might use one plan for your basic health needs and another for dental or vision coverage. Each employee can mix and match based on their own specific needs.

The plans and pieces we’re discussing can include Health Share, preventive plans, copay plans, virtual care, labs, medications, dental, vision, and accident coverage. Some people might only need one or two of these, while others might combine several to ensure comprehensive care. This flexibility is especially valuable in small businesses, where employees may have varying needs, from managing chronic conditions to requiring certain providers for routine preventive care.

Importance of Using Plans Correctly

Understanding when to use your plan’s ID card and when to present as self-pay is a key part of managing multiple healthcare plans effectively. When using ShareWELL, members should always present as self-pay at the time of service and request to receive the bill directly. This applies to any service intended to be shared through ShareWELL, such as emergency room visits, surgery, that exceeds the member’s Unshared Amount. These bills are submitted by the member directly to ShareWELL through a Sharing Request.

In contrast, services covered under supplemental plans, such as preventive care or copay plans, dental, or vision, follow a traditional process where you present your ID card, and the provider sends the claim directly to the plan. Using your ID card in a situation that should be self-pay can lead to billing delays, additional administrative work, and higher costs for both the member and the ShareWELL community. Following the right steps helps ensure that your care is processed smoothly and your healthcare remains cost-effective and easy to manage.

Medical Bill Claim portal to check claim status when presenting an ID card for Copay or HSA plan. Search for doctors and services (select PHCS Practitioner & Ancillary) for the copay and HSA plan that requires the use of the PHCS network.

Lower Monthly Costs and Reduced Out-of-Pocket Spending

Surprisingly, using multiple plans can result in a significantly lower monthly payment and reduced out-of-pocket spending over the year. At first glance, having several plans might seem to increase your expenses, but the reality is quite the opposite. You avoid paying for unnecessary services bundled into one expensive plan by picking specific coverage options based on your personal or business needs.

For instance, we often purchase a conventional plan that is rarely used, and the deductible is never reached. You can choose Health Share, which has lower costs, and add the other pieces only if needed. This results in a tailored approach that helps you save money with maximized coverage. Many Health Share programs, for instance, pair perfectly with a copay plan or preventive care to give you a way to spend less on healthcare.

Learning Curve, but Greater Rewards

Yes, there’s a learning curve when managing multiple plans. You’ll need to understand how each plan works, what it covers, and when to use it. But this extra effort will reward you with a healthcare system that perfectly fits your lifestyle and financial needs. This approach includes advocacy services by ShareWELL Partners designed to provide the highest level of customer service and assist with the learning curve. Think of it like learning the pieces of a puzzle—you might start with a few key plans like virtual care or preventive care, and add others like accident coverage, labs, or medications as needed.

Once you become familiar with the ins and outs of each plan, you’ll be able to maximize your healthcare benefits while minimizing costs. For instance, understanding when to use your virtual care plan versus going to an in-person provider can save you both time and money.

Conclusion: A Smarter Way to Approach Healthcare

Healthcare doesn’t have to be expensive or frustrating to manage. By choosing multiple plans and customizing them to fit your needs, you can save money and get better coverage. Whether it’s Health Share, preventive care, or adding coverage for medications, dental, or vision, the key is to combine different pieces to form a complete healthcare puzzle that works best for you.

So, don’t settle for a one-size-fits-all approach. By securing advocacy support, tailoring your healthcare, reducing overall costs, and learning the management of multiple plans, you can ensure the best coverage for your needs without overpaying.

For more information or assistance with setting up the best combination of plans, don’t hesitate to reach out to our team. We’re here to help you confidently manage your healthcare puzzle.

The math of a real-life example:

A Traditional Family Plan– $1,500 monthly

comes with a $5,000 deductible

A Customized Approach– $900 monthly

Includes $1,500 UA Health Share, Preventive Copay plan, Dental, Vision, $0 Copay Virtual Urgent Care, and $0 labs.

*The result is more services with little to no out-of-pocket cost and a more comprehensive selection of providers and services.