FAQs

ShareWELL Health Share

Members join ShareWELL because they want a smarter, more affordable way to manage their healthcare while being part of something meaningful. As a 501(c)(3) non-profit health care entity, ShareWELL is more than just another health share community. Every member’s healthcare journey matters, and together we are reshaping how people experience care—one shared need at a time. Our Member Guidelines are built around transparency and clarity, giving every member a clear understanding of how the community works and what to expect from the moment they join.

People join ShareWELL because they want to save money on their healthcare while gaining freedom and clarity in how they manage it. A ShareWELL membership offers healthcare freedom, meaningful savings, and a safety net for life’s unexpected needs. Members appreciate being able to choose their own doctors and care providers, see the true cost of their services, and participate in a community that supports one another. While each individual, family, and business joins for different reasons, these shared values make the ShareWELL experience a more empowering and better way to approach healthcare.

ShareWELL is a community of people from all over the US who benefit from the power of sharing in one another’s medical expenses. Our Advocacy team works with members to negotiate and attain fair pricing for medical services. As direct and self-pay patients, our members experience lower medical bills by leveraging ShareWELLS resources. Our community is there to support fellow members when they need it the most, and that is why there are no maximum sharing caps or limits on how much is available to share for larger medical expenses.

The tax penalties are no longer enforced on the federal level, some states have mandates requiring health insurance coverage. A ShareWELL membership does not satisfy this requirement in states where a tax penalty is still enforced.

The cost of membership is based on household size, elected Unshared Amount, and tobacco use. Most of our members will reduce their healthcare costs by about 50% compared to more traditional healthcare options.

Members are able to join ShareWELL in different ways. If you are a business with 2+ employees, you can check out our partner to learn more. For individuals and families who are interested in direct primary care with their ShareWELL membership, you can check out our ShareWELL + DPC membership to learn more. If you want to join with our preventive program directly, you can click the join now link on our website to get started. The membership can start as soon as the next day and signup can be done in just a few minutes.

The initial Unshared Amount, or UA, is the amount a member will pay before the ShareWELL community shares in eligible medical expenses. The UA is also known as personal responsibility. ShareWELL has three levels: $1,500,$3,000, and $6,000. The lower your UA, the higher your monthly contribution will be. All qualifying medical expenses submitted after the UA is met are shareable with the ShareWELL community at one hundred percent. There is no annual or lifetime limit. You will not need to pay the UA for a single need again until you are symptom-free for 12 months. Additionally, you will not be responsible for more than two UAs in a rolling 12-month period. Included wellness and preventive services do not require members to meet a UA first and are immediately shareable without waiting periods. There are several different preventive and wellness programs that you may include, see your applicable one for details.

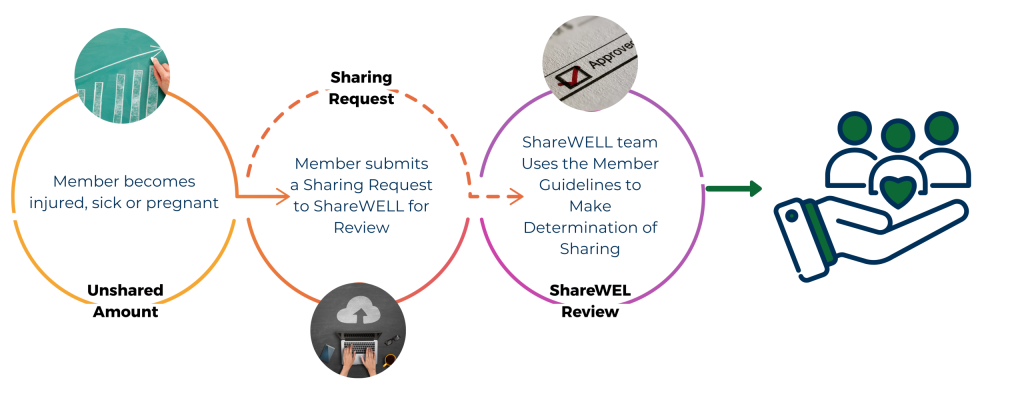

When a member submits medical bills for sharing to the ShareWell community, it is done through a Sharing Request. Sharing Requests are submitted by members on a per-member, per-incident basis. There are two types of sharing requests that are based on eligible preventive care or expenses that exceed a member’s Unshared Amount. The related expenses are evaluated according to the Membership Guidelines and the applicable preventive services with your membership for eligibility.

A Health Share is an arrangement whereby members agree to share medical expenses through voluntary giving. It is made up of like-minded individuals who all agree on the standards outlined in the Membership Guidelines. A Health Share is NOT insurance or registered by any insurance.

No, Medical Cost Sharing traces its origins back many years to the Amish and Mennonite communities. It began expanding in the 1980s with the advent of large, Christian-based healthcare-sharing ministries.

The concept has since evolved into principled and religious-based communities. Still, the purpose remains the same: for the community to help relieve the burden of medical bills for members in their time of need.

Generally, medical events exceeding a member’s Unshared Amount related to a new injury, illness, or pregnancy are eligible for sharing. Sharing is not available for conditions that existed before joining in the first year of membership. Your membership may also provide sharing and allowances for preventive and wellness services without members needing to meet their UA. We have also expanded sharing for the ShareWell community to include alternative and holistic approaches to treatment and care.

No. There are no lifetime maximums, monthly caps, or other limitations on how much funding can be shared for eligible medical expenses. Certain care may have a sharing allowance that will be clearly outlined in the member guidelines. The allowances are designed to give personal responsibility back to the patient.

Pre-existing conditions not related to preventive care that may be included with your membership will have limitations. Sharing for care related to a pre-existing condition will begin after one year of membership and increase each year for four years.

* If you would like to discuss your personal pre-existing condition-sharing options, please contact our team

Yes, in fact many of our members will spend a fraction of what is typically owed for those using traditional methods to cover their care. Our maternity program includes prenatal, delivery, postnatal, homebirth, midwives, and doulas. Members who keep the cost down for the ShareWell community may be eligible to have part of their UA responsibility waived. Members are able to use a wide variety of prenatal and postnatal services that are not often covered by traditional plans. (Maternity Guide)

These costs can be shared, regardless of where they occur, as long as the Sharing Request is eligible based on the Member Guidelines. The ShareWELL community also can support the choice of alternative care outside the US.

It means being able to make your own healthcare choices without them being dictated by a network or other restrictions. The traditional system is not designed to allow for choice, and ShareWELL allows members to seek care on their terms from their choice of clinician.

ShareWELL is a different way of approaching healthcare that saves money on monthly costs and when using healthcare. It starts with our monthly contribution, which can be 20-50% less than traditional options. Our UA model is designed to keep out-of-pocket costs lower than the traditional methods, resulting in more savings when we need it most. Lastly, our members can choose to access many no-cost preventive and wellness services to stay on top of their health. In the long term, by investing in prevention, our members save money on expensive treatments.

We will use several methods to help our members attain fair costs for healthcare services.

- Request self-pay– Our members always present as self-pay and request any discounts that are available

- Prompt pay– We ask our members to facilitate payment directly to the provider as quickly as possible to ensure any prompt payment discounts are applied.

- Self-Pay Resources-ShareWELL’s Advocacy team what resources are available.

- Negotiation– Our thorough negotiation process can often lower bills that are not paid in advance and are at least $1,000.

- Packaged/Bundled discounts– For services like recovery care, maternity, or surgical needs offering to pay for services in advance as a package to reduce bills significantly. We encourage and help members to ask the right questions to see if this option is available.

The use of tobacco products, including cigarettes, cigars, pipe tobacco, and chewing tobacco, one or more times per month.

An Explanation of Sharing Summary (ESS) is a document from ShareWELL that details how your submitted medical bills were processed and shared. It includes:

- Member Info: Your membership details.

- Event Description: Overview of the medical event.

- Itemized Bills: List of charges and services.

- Unshared Amount (UA): Your out-of-pocket costs.

- Sharing Contributions: Amount shared by the community.

- Payment Method: How funds were distributed.

- Remaining Balance: Any unpaid amount.

- Notes: Explanations of any adjustments or non-eligible expenses.

The ESS provides transparency and clarity on how your healthcare costs were managed and supported by the community.

The savings with a ShareWELL membership vary based on individual healthcare needs and usage. Generally, members can save through:

- Lower Monthly Contributions: Compared to traditional insurance premiums.

- Preventive Care: Encouraged and covered with certain memberships, reducing long-term costs. (Preventive care varies by membership and is chosen at enrollment)

- Flexible Provider Choices: Potentially lower costs with nontraditional and holistic options.

- Community Sharing: Shared expenses can lower your overall healthcare costs.

For a precise estimate, compare your current healthcare expenses with your monthly ShareWELL contributions and your Unshared Amount (UA).

At the Provider’s Office:

- Identify as Self-Pay: Inform the office you are a self-pay patient.

- Request a Discount: Ask for any available self-pay discounts.

- Get an Itemized Bill: Request a detailed bill for the services you receive.

- Submit to ShareWELL: Submit the bill through the ShareWELL member portal.

After Submission:

- Open a Sharing Request: If it’s a new medical event, open a request that stays active during your treatment.

- Choose Payment Method: ShareWELL may pay the provider directly, reimburse you, provide an advance, or issue an instant debit card.

Support:

– Advocacy Team: Available to help with communication and fair pricing.

– Timely Submission: Submit bills promptly and respond to any ShareWELL requests for additional documentation.

Yes, there are sharing limitations at ShareWELL. Pre-existing conditions not related to preventive care that may be included with your membership will have limitations. Sharing for care related to a pre-existing condition will begin after one year of membership and increase each year for four years. Also, expenses below your UA are not shared. For detailed information, refer to your membership guidelines.

* If you would like to discuss your personal pre-existing condition-sharing options, please contact our team

If you get cancer, ShareWELL can share eligible medical expenses as with any other type of Sharing Request. However, if it’s a pre-existing condition diagnosed within 36 months before joining, sharing limitations apply. For specific details, refer to your Membership Guidelines.

No, ShareWELL is not like a conventional plan. It is a Health Share Community that does not meet the Affordable Care Act standards for health insurance. ShareWELL has designed a membership that fits the needs of its members, but does not meet conventional requirements.

To see what preventive care is available, you will need to check which membership you are enrolled in. The membership can include or may not include preventive services. You may also have chosen to enroll in a plan that works in conjunction with ShareWELL, but is not administered by ShareWELL that provides preventive services.

To submit bills to the ShareWELL community:

- Get an Itemized Bill: Request a detailed bill from your provider.

- Submit a Sharing Request:

- Follow Up: Respond to any requests for additional information or documentation from ShareWELL.

Yes, ShareWELL allows you to choose any doctor or provider you prefer.