At ShareWELL Health Share, we understand that healthcare can be confusing, especially when it doesn’t follow the traditional insurance model many are used to. Our approach is different, and intentionally so. As a non-profit Health Share community, our mission is to simplify how individuals and families manage their medical costs by promoting transparency, flexibility, and member-driven support. For many, the first step in this journey starts with our Essential Membership.

What Is the Essential Membership?

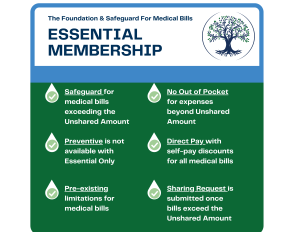

The Essential Membership is the core offering at ShareWELL. It serves as the foundation of your healthcare strategy and safeguards for unexpected medical events. This membership type is designed for those who want to safeguard themselves from high medical bills without overpaying for unnecessary coverage.

With the Essential Membership, you are part of a Health Share community where members voluntarily contribute funds that help cover one another’s eligible medical expenses. When a member’s medical bill exceeds their chosen Unshared Amount (UA), the portion they are responsible for, those community funds may be used to help share the cost, as long as the need aligns with our Member Guidelines.

The Role of the Unshared Amount (UA)

Think of the UA as your personal threshold. Before any community sharing can occur, you are responsible for medical bills up to your UA. Once this amount is met, and if the services are eligible per the Member Guidelines, the remaining costs can be shared among members. This structure empowers you to choose the level of personal responsibility you’re comfortable with while still having a community to support you when the unexpected happens. While some may like this low monthly cost, others may prefer to customize a more comprehensive approach around it with other benefits.

The Foundation for Customizing Your Coverage

The Essential Membership is not a one-size-fits-all solution. Instead, it’s meant to be the anchor that allows you to build a healthcare bundle that works for your lifestyle and healthcare needs. While the Essential Membership provides vital protection for unexpected expenses, like an ER visit, it can be enhanced through other healthcare tools and options.

Many members pair their ShareWELL membership with industry-leading plans and services. These may include doctor’s office plans with built-in copays, telehealth memberships, HSA-compliant plans, or benefits for labs, dental, and vision care. Direct Primary Care (DPC) is another popular option, offering unlimited access to a physician for a flat monthly fee and complementing the Essential Membership by covering routine visits and minor concerns.

When used together, these options can create an incredibly comprehensive healthcare approach. Even with this customized combination, members often see 30 to 60 percent savings in total healthcare spending compared to traditional plans.

Savings That Make a Difference

One of the most compelling aspects of ShareWELL is the cost savings. On its own, the Essential Membership is typically 50 to 70 percent less expensive than the monthly premiums of a traditional insurance plan. And even when paired with additional services to create a broader, customized health strategy, total healthcare spending is often still 30 to 60 percent lower than traditional plan costs. Much of this savings comes from lower out-of-pocket spending beyond just the lower monthly cost.

This financial flexibility means you can redirect savings toward everyday care, proactive wellness, or long-term financial goals, knowing you have a safeguard for larger, unexpected expenses.

Some members, especially those who rarely use healthcare services or prefer to pay out of pocket for everyday care, choose to use only the Essential Membership in their planning. This streamlined approach provides peace of mind for larger medical events while keeping spending minimal and predictable.

How much does Essential cost each month?

| UA 1500 | UA 3000 | UA 6000 | |

| Member Only | $220 | $175 | $125 |

| Member & Child(ren)

Member & Spouse |

$410 | $315 | $250 |

| Family | $575 | $455 | $385 |

Understanding the Limitations

Because ShareWELL operates as a Health Share, not insurance, there are some limitations you’ll want to be aware of. These differences are not drawbacks, but they do require a shift in mindset.

For example, pre-existing conditions come with a phase-in period. This means that if a medical condition existed prior to joining, sharing for related expenses is limited during the early years of your membership. Similarly, maternity-related needs have a 30-day waiting period. If conception is within the first 30 days of membership, it will not be eligible for sharing.

These guidelines are clearly defined and help keep the community sustainable. However, they differ from what many expect from an insurance background, which is why understanding them upfront is so important.

A Community-Focused Approach to Healthcare

At its heart, the Essential Membership isn’t just about dollars and cents. It’s about being part of something greater. As a ShareWELL member, you’re not just paying into a system; you’re supporting real people in times of need and, in turn, receiving support when you need it most.

Our members come from diverse backgrounds but share a common goal: accessing quality healthcare without unnecessary barriers or costs. Whether you’re self-employed, a small business owner, an out-of-the-box thinker, or simply looking for a better way to manage your healthcare, the Essential Membership can be a smart, values-driven option.

Final Thoughts

The Essential Membership at ShareWELL offers more than just financial protection, it provides peace of mind. By joining a Health Share community, you’re embracing a model built on trust, transparency, and mutual support. With the freedom to customize your care and the power of a like-minded community behind you, you’re in control of your health journey.

Before you enroll, take the time to review our Member Guidelines and understand how sharing works. Knowledge is empowerment, and we’re here to help every step of the way.