Making the Switch to ShareWELL: A Positive Change for Employees

Trying something new in healthcare can feel unfamiliar, but that doesn’t mean it isn’t proven. For over 40 years, families have used approaches outside of traditional group plans to save money and gain more control. The real mistake is falling back on a system everyone knows is broken, paying more each month while facing higher costs when care is needed. With ShareWELL as the foundation, members can combine other benefits and solutions to build a smarter, more flexible plan that truly works for their family.

Freedom to Choose Any Clinician

A benefit of ShareWELL is the freedom it offers when choosing healthcare providers that are not limited to small networks that we have become accustomed to navigating. Whether it’s a doctor you’ve been seeing for years or a specialist you need to consult with, you will have more freedom to see the clinicians you choose.

This means you have the freedom to seek out the best care available without worrying about whether a provider is “in-network.” You’re in control of your healthcare decisions and can prioritize quality care over bureaucratic restrictions. This level of autonomy can alleviate the frustration many experience with more rigid healthcare systems, and it’s one of the key reasons employees find ShareWELL appealing.

True Flexibility: Customizing Your Healthcare Package

When we talk about flexibility with ShareWELL, we’re not just referring to the ability to keep your doctor—you also have the freedom to customize your healthcare package by combining ShareWELL with other healthcare-related products. Many employers offer ShareWELL alongside complimentary plans, virtual care, advocacy services, direct primary care, dental, vision, and wellness options, allowing employees to build a healthcare solution that fits their specific needs.

This means that instead of the one-size-fits-all approach typical of traditional plans, you can choose the services that make the most sense for you and your family. For example, you might use ShareWELL for general healthcare needs but opt for an additional wellness plan or extra coverage for specific treatments. This ability to mix and match products allows you to create a more tailored and cost-effective healthcare solution.

This flexibility can also help you avoid paying for services you don’t need. With traditional setups, you may be paying for blanket coverage that doesn’t fit your specific situation. But with the ShareWELL approach, you can decide exactly what’s important to you, saving money while still ensuring you’re fully covered where it matters most.

Lower Cost For Employers and Employees

One of the most appealing aspects of ShareWELL is the potential for significantly lower monthly contributions. As a community-based system, ShareWELL allows members to share healthcare costs, which often leads to lower overall expenses compared to traditional plans. This sharing model reduces the financial burden of healthcare without compromising the quality of care.

For employees, this means more manageable healthcare costs, allowing them to allocate savings toward other financial goals. However, the benefits go beyond individual savings—employers also stand to save. Employers can reinvest those savings into their benefits packages by paying less for healthcare. For instance, if an employer is paying half as much for healthcare through ShareWELL, they may be able to cover a more significant portion of other benefits, like retirement contributions or wellness programs, which further enhances the overall compensation package for employees.

This cost-saving structure creates a win-win situation: employees get the flexibility and coverage they need, while employers can expand their benefits offerings without increasing costs. And with ShareWELL’s transparent, predictable costs, there are no hidden fees or unexpected charges to worry about.

Different Doesn’t Mean Worse—It Often Means Better

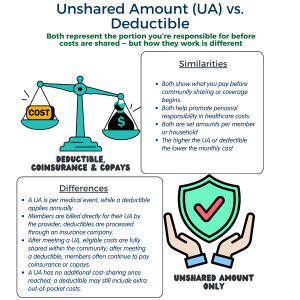

Choosing a different path in healthcare doesn’t mean sacrificing quality or security; it means rethinking what’s possible. At ShareWELL, we believe doing healthcare differently means doing it better for most people. Consider the concept of an Unshared Amount, for example, it functions similarly to a deductible but differs, offering a more practical approach to out-of-pocket expenses. Rather than paying high monthly premiums that cover a wide range of services you might never use, ShareWELL allows members to pay a lower monthly contribution and take care of smaller expenses themselves. Instead of being locked into a provider network, members can self-pay and access care from any clinician they trust. This model puts control in your hands rather than behind-the-scenes processes dictated by insurance companies. And because ShareWELL is a nonprofit community, the focus is on supporting members, not maximizing shareholder returns. It’s a transparent, values-driven approach that aligns better with how people actually want to experience healthcare.

Understanding Limitations: Pre-Existing Conditions

While ShareWELL offers considerable benefits, it’s important to understand that it may not be the best fit for every employee or family member. The flexibility and cost savings of ShareWELL come with some limitations, particularly when it comes to pre-existing conditions. ShareWELL may have restrictions on coverage for certain pre-existing medical conditions, and these limitations could impact how well it serves the needs of specific individuals.

For some families, this might mean that purchasing a traditional plan, which tends to offer more immediate and comprehensive coverage for pre-existing conditions, is a better choice for specific family members. This blend of solutions—using ShareWELL for most families while choosing a traditional plan for those who need it—helps balance costs and coverage.

Enhancing ShareWELL with Additional Coverage Options

It’s common for employers offering ShareWELL to pair the membership with other benefits to enhance the overall healthcare package. These complementary plans may include coverage for preventive care, telemedicine, copay options for routine doctor visits, prescription discount programs, or even the ability to contribute to and use a Health Savings Account (HSA). This creates a hybrid approach, where employees get the flexibility and cost savings of ShareWELL while still having access to familiar benefits that help cover everyday healthcare expenses. By blending these options, employers can offer a more comprehensive benefits package that meets diverse employee needs while still keeping costs lower than traditional group plans.

A Transparent and Supportive Community

At the heart of ShareWELL is its community-based approach with advocacy support for all its members. Members contribute to one another’s medical expenses, fostering a supportive and transparent environment. Unlike traditional plans that can feel impersonal, ShareWELL encourages a sense of connection and shared responsibility among its members. You’re not just another policy number—you’re part of a group working together to manage healthcare costs effectively.

A More Personal Approach to Healthcare

ShareWELL offers employees the chance to take control of their healthcare in a flexible, personalized, and cost-effective way. By understanding the limitations, particularly regarding pre-existing conditions, employees can make informed decisions about whether ShareWELL is the right fit for them and their families.

This customizable approach—where you can mix and match healthcare products—empowers you to create a healthcare solution tailored to your needs. While it may take more thought upfront, the potential for savings and freedom of choice makes it a compelling alternative to traditional group plans.