A Completely Customizable Healthcare Experience For Entrepreneurs

Health Care Designed For You by You

ShareWELL helps entrepreneurs save on healthcare with predictable monthly costs, no subsidies, and the freedom to choose their own providers.

Why ShareWELL is a Good Fit for Entrepreneurs

ShareWELL is a practical and empowering option for entrepreneurs who want to save money on healthcare while avoiding the high costs, subsidies, and confusion of traditional plans. For business owners and self-employed professionals with unpredictable incomes, ShareWELL provides a consistent and transparent way to manage healthcare expenses through predictable monthly contributions. Members gain freedom to choose their own doctors and care options—without being tied to complex networks or inflated premiums. It’s a smarter, simpler approach that helps entrepreneurs protect their health and their bottom line.

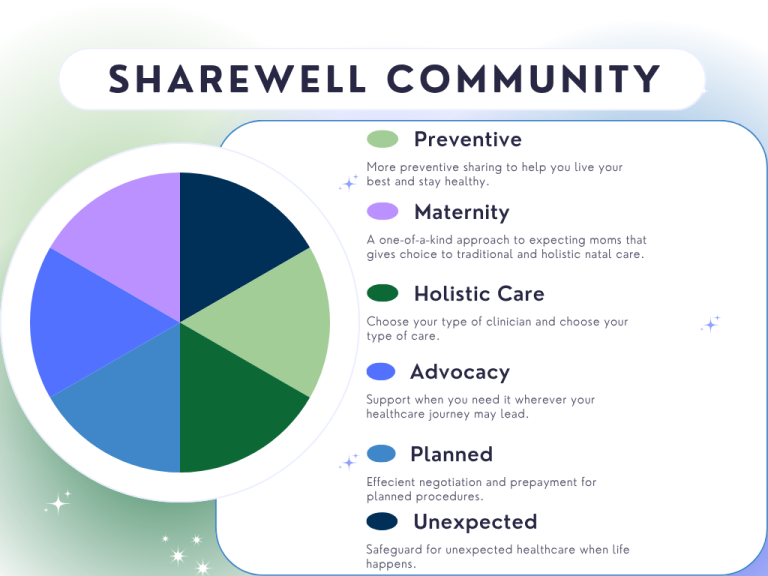

Choose Your Healthcare Solutions

Health Share

Safeguard for the unexpected in life

Maternity

Holistic & Traditional maternity sharing

Mental Health

$0 Virtual counseling

Labs

Comprehensive sharing for labs

Holistic

Sharing for holistic care

Preventive

Customize the preventive care you need

Jane and Jill: A Tale of Two Entrepreneurs Planning Their Healthcare

Jane and Jill are both busy entrepreneurs, each managing their businesses while budgeting their healthcare. They take different approaches, and their choices lead to vastly different outcomes by the end of the year.

Jill purchases a plan through Healthcare.gov, paying $500 per month with a $5,000 deductible. It seems like a reliable option, though costly. Meanwhile, Jane joins ShareWELL, opting for a membership with all the bells and whistles for $330 a month. She’s drawn to the monthly savings but wonders how it will compare to Jill’s traditional plan at years end.

Throughout the year, both women end up using their healthcare more than expected. Each has 5 in-person mental health consultations, 2 virtual sick visits with medications, a physical, a well-woman visit, a dermatologist check-up, and an emergency room visit costing $5,000.

By year’s end, Jill calculates her total costs: between her monthly payments and deductible, she’s spent $11,350. She also had to switch doctors midyear to stay within her HMO network, and couldn’t access the functional medicine she wanted. Jane, on the other hand, finds her total expenses amount to $6,960. Her ShareWELL membership allowed her to see any doctor she wanted and even pursue the functional medicine that interested her.

In the end, Jill’s traditional insurance plan was far more expensive and restrictive, while Jane’s ShareWELL membership provided both flexibility and significant savings—Jill spent $11,350, while Jane spent just $6,960. A savings of $4,390!

The Healthcare Puzzle

How Pricing Works

Step 1- Choose Your Unshared Amount

Step 2- Choose what you want to include

Step 3- Join in minutes

$3,000 UA

(2 Per Rolling 12 Months)

Member Only

$300 / Month

Member & Spouse

$570 / Month

Member & Child (ren)

$570 / Month

Member & Family

$850 / Month

Member Only

$325 / Month

Member & Spouse

$625 / Month

Member & Child (ren)

$625 / Month

Member & Family

$950 / Month

$5,000 UA

(2 Per Rolling 12 Months)

Member Only

$250 / Month

Member & Spouse

$485 / Month

Member & Child (ren)

$485 / Month

Member & Family

$725 / Month